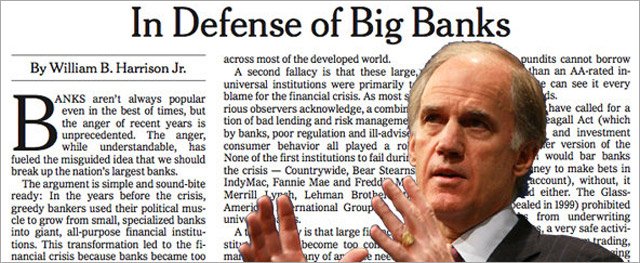

Tuesday’s New York Times ran an opinion piece by William B. Harrison, Jr., former Chairman and CEO of J.P. Morgan, in which he defends the existence of megabanks. I recognized many of his arguments because I’d heard them two years ago from Wall Street lobbyists when I worked in the U.S. Senate. “We need big banks to compete in global markets” one lobbyist would say. “Size isn’t the issue; it’s risk and interconnectedness that matter,” said another. “None of the largest banks failed,” another would claim. To my mind, Mr. Harrison’s only novel, but equally spurious, claim is that big banks haven’t become too politically powerful (which would be imprudent for bank lobbyists to concede).

Only the megabanks themselves—and a diminishing number of senators, representatives, and regulators eager to placate them—continue to mouth Wall Street’s big lies. Yet it’s simply not true that our largest banks would’ve survived without taxpayer assistance. Citigroup and Bank of America (two of our largest banks) would‘ve failed without TARP money and unlimited access to Fed loans. Across the Atlantic, the Royal Bank of Scotland, Britain’s largest bank, also went bust. In the tempest of the financial crisis, most megabanks flailed; and a few failed.

On these issues, voices outside the banking community are more credible than Mr. Harrison’s. When my former boss, then Senator Ted Kaufman (D-DE), heard lobbyists and senators defend the size of megabanks, he was prepared to rebut them. He’d quote Mervyn King, Governor of the Bank of England, and Alan Greenspan, the former Federal Reserve chairman. King had said: “Banks who think they can do everything for everyone all over the world are a recipe for concentrating risk.” And Greenspan had admitted that Fed research “had been unable to find economies of scale in banking beyond a modest-sized institution.”

There are no economies of scale or scope for banks whose assets exceed $100 billion. The Brown-Kaufman amendment, which Senators Sherrod Brown (D-OH) and Kaufman offered in the Senate (and which lost owing to opposition from the Obama Treasury Department and the hypertrophic political muscle of Wall Street megabanks), would have limited the size of systemically significant megabanks but left intact banks with as much as $1 trillion in assets. That’s plenty big and plenty competitive on a global scale. Defending the existence of large global banks is one thing. Defending the existence of megabanks that have grown so large that their assets represent a significant percentage of U.S. GDP is another. No one needs our current behemoth banks; they create no additional value and deliver no additional cost savings. Executives outside the financial sector understand that the U.S. economy needs financial stability, not ever-expanding, risk-avid megabanks.

Mr. Harrison also believes that megabanks and moderately sized banks are equally difficult to manage and regulate. Yet a decade ago, Greenspan said: “I noted that ‘megabanks being formed by growth and consolidation are increasingly complex entities that create the potential for unusually large systemic risks in the national and international economy should they fail.’ Regrettably, we did little to address the problem.”

Regrettably, the U.S. Congress also did little to address the too-big-to-fail problem. That’s why the debate about too-big-to-fail continues to rage. The Dodd-Frank Act’s notion of making megabanks draft “living wills” so that they can dismember themselves in an orderly fashion before they fail (and wreak systemic havoc) hasn’t struck many people as a viable solution. The new resolution authority granted to U.S. regulators by Dodd-Frank is unlikely to work with global megabanks, since it doesn’t apply to their operations beyond our shores. Even most Republican senators, who offered few significant reforms during the Senate debate, grasp that U.S. bankruptcy laws wouldn’t work if another global bank fails, because these laws differ in the dozens of jurisdictions in which megabanks operate.

As a former lobbyist myself, it took returning to the Senate after the financial crisis for me to realize how one-sided political power on banking and securities issues has become. I’d been a corporate lobbyist for 12 years, but I believed that the financial crisis was a seismic event that would shock (and awe) President Obama, legislators, and regulators into action. And that they would bring all-too-powerful banks under control. As Ted Kaufman said repeatedly, Congress should’ve enacted structural reforms like those of the 1930s, which preserved financial stability for three generations. But that didn’t happen. And now we’re left with larger-than-ever megabanks acting lawlessly (as the LIBOR scandal shows) and excessively (as the London whale proved) and continuing to cause financial instability. Ironically, Sandy Weill, the megamind that created the megabank Citigroup, recently shocked Wall Street by advocating the reinstatement of the Glass Steagall Act. Mr. Harrison—and Washington—would do well to heed a Weill.

THE PAYOFF: Why Wall

THE PAYOFF: Why Wall

Pingback: Simon Johnson: One Man Against The Wall Street Lobby | Screw Cable

Pingback: Simon Johnson: One Man Against The Wall Street Lobby | Blog

Pingback: Simon Johnson: One Man Against The Wall Street Lobby | | DigaNewsDigaNews

Pingback: Simon Johnson: One Man Against The Wall Street Lobby | USA Press